DOGE Price Prediction: Analyzing the Path to Recovery Amid Mixed Signals

#DOGE

- Whale accumulation is providing support despite security concerns

- Technical indicators show mixed signals with bearish MACD but stable Bollinger Band positioning

- Institutional acquisition activity suggests long-term ecosystem growth potential

DOGE Price Prediction

Technical Analysis: DOGE Shows Mixed Signals Near Key Moving Average

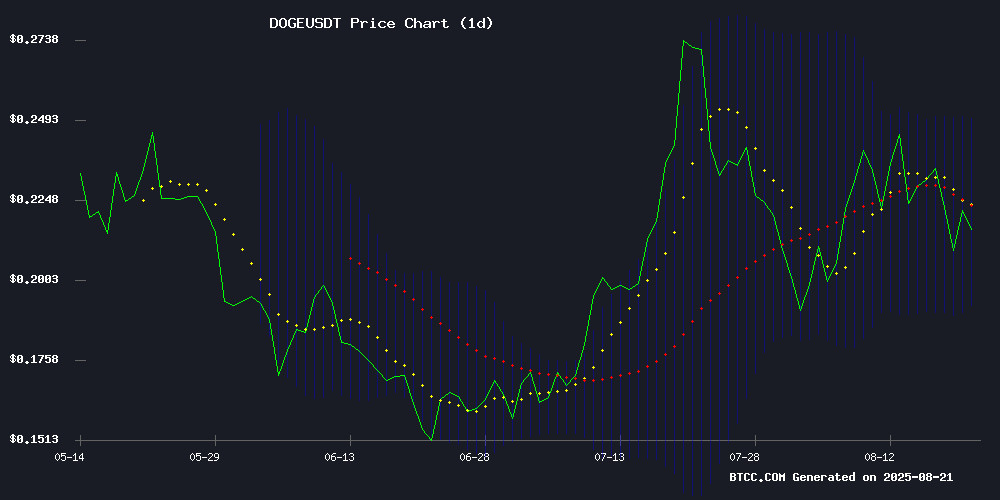

According to BTCC financial analyst Olivia, Doge is currently trading at $0.21862, slightly below its 20-day moving average of $0.221256. The MACD indicator shows a bearish crossover with values of -0.009129 (MACD line), -0.004434 (signal line), and -0.004695 (histogram), indicating short-term downward momentum. However, the price remains within the Bollinger Bands range of $0.192599 to $0.249912, suggesting the current movement may represent normal volatility rather than a strong trend reversal.

Market Sentiment: Whale Accumulation Offsets Security Concerns

BTCC financial analyst Olivia notes that recent news presents a mixed picture for DOGE. While security concerns from Qubic's 51% attack threat caused initial selling pressure, significant whale accumulation has supported a late-session recovery. The $50M acquisition of Dogehash by Thumzup Media demonstrates continued institutional interest in expanding Dogecoin's mining ecosystem, which could provide fundamental support despite short-term volatility.

Factors Influencing DOGE's Price

Dogecoin Whales Accumulate Amid Security Concerns, Driving Late-Session Recovery

Dogecoin (DOGE) surged 5% to $0.22 in late trading on August 20, 2025, recovering from intraday lows of $0.21. The rally was fueled by a spike in volume to 9.29 million DOGE in the final hour, signaling institutional-sized flows.

Whale investors accumulated over 680 million DOGE throughout August, countering retail selling pressure sparked by Qubic's potential 51% attack threat. Large holders appear to be leveraging the security FUD as an accumulation opportunity.

Technical charts show a descending triangle pattern that could trigger a 40% price swing. Long-term targets remain ambitious at $0.70-$1.30, despite DOGE's 22% monthly decline.

Thumzup Media Acquires Dogehash in $50M Stock Deal to Boost Dogecoin Mining Ecosystem

Thumzup Media, a Nasdaq-listed crypto-focused treasury firm backed by the Trump family, has announced the acquisition of Dogecoin mining company Dogehash in an all-stock transaction valued at $50 million. The deal will see Dogehash shareholders receive 30.7 million Thumzup shares, with the merged entity to be listed on Nasdaq under the ticker "XDOG."

The acquisition aims to create a vertically integrated Dogecoin ecosystem, combining mining infrastructure with renewable energy and utility-driven applications. Thumzup CEO Robert Steele emphasized the strategic pivot from social media marketing to a crypto-led strategy, fueled by recent $50 million fundraising for mining rigs and digital asset accumulation.

Dogecoin Plunges Amid Qubic's 51% Attack Threat, Whales Accumulate

Dogecoin faced a sharp 5% decline as the Qubic blockchain community voted to target DOGE for a potential 51% attack, echoing its recent disruption of Monero's network. Security concerns overwhelmed the market, triggering a sell-off despite persistent whale accumulation.

The proposal to redirect hashpower toward Dogecoin rattled traders, with futures open interest dropping 8% as confidence waned. Whale wallets absorbed 680 million DOGE in August, signaling divergent views between short-term panic and long-term conviction.

Price action turned volatile, with DOGE sliding from $0.22 to $0.21 during peak trading hours. The $0.22 level solidified as resistance after repeated rejections, while $0.21 emerged as tentative support. Trading volumes spiked to 916 million tokens during the sell-off—double the daily average—before settling into a tight range overnight.

How High Will DOGE Price Go?

Based on current technical indicators and market sentiment, DOGE could potentially reach the upper Bollinger Band around $0.25 in the near term if whale accumulation continues and security concerns subside. However, the bearish MACD crossover suggests any upward movement may face resistance near the 20-day MA at $0.221.

| Price Level | Significance | Probability |

|---|---|---|

| $0.25 | Upper Bollinger Band Resistance | Medium |

| $0.221 | 20-day MA Resistance | High |

| $0.193 | Lower Bollinger Band Support | Low |